Uneven cash flow stream calculator

In the previous section we looked at the basic time value of money keys and how to use them to calculate present and future value of lump sums and annuities. Where N is a number of periods CF t is a cash flow at period t and r is an interest rate per period.

How To Use An Hp 10bii Financial Calculator Propertymetrics

The appropriate interest rate is 9.

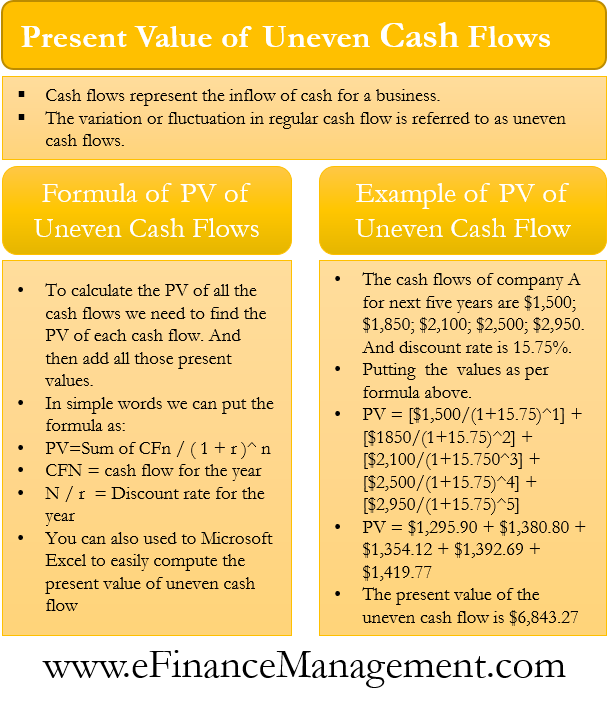

. Shown below is an example of an uneven cash flow stream. NPV Rate Initial Outlay Cash Flows Cash Flow Counts. Present value of cash flow stream can be found using the NPV functio.

Using the key One can also find the interest rate. We either calculate the. For example amount funded is on 131 first payment due is on 31.

To find the present value of an uneven stream of cash flows we need to use the NPV function. 143-154The link to the calcula. This function is defined as.

How to Use Our Uneven Cash Flow Calculator. Present value of an uneven stream of cash flows solved using the TI BA II Plus calculator. It is fairly easy to work this problem dealing.

This video demonstrates how to calculate the Future Value of a series of uneven cash flows using a BAII Plus calculator. When a cash flow stream is uneven the present value PV andor future value FV of the stream are calculated by finding the PV or FV. NPV Rate Initial Outlay Cash Flows Cash Flow Counts.

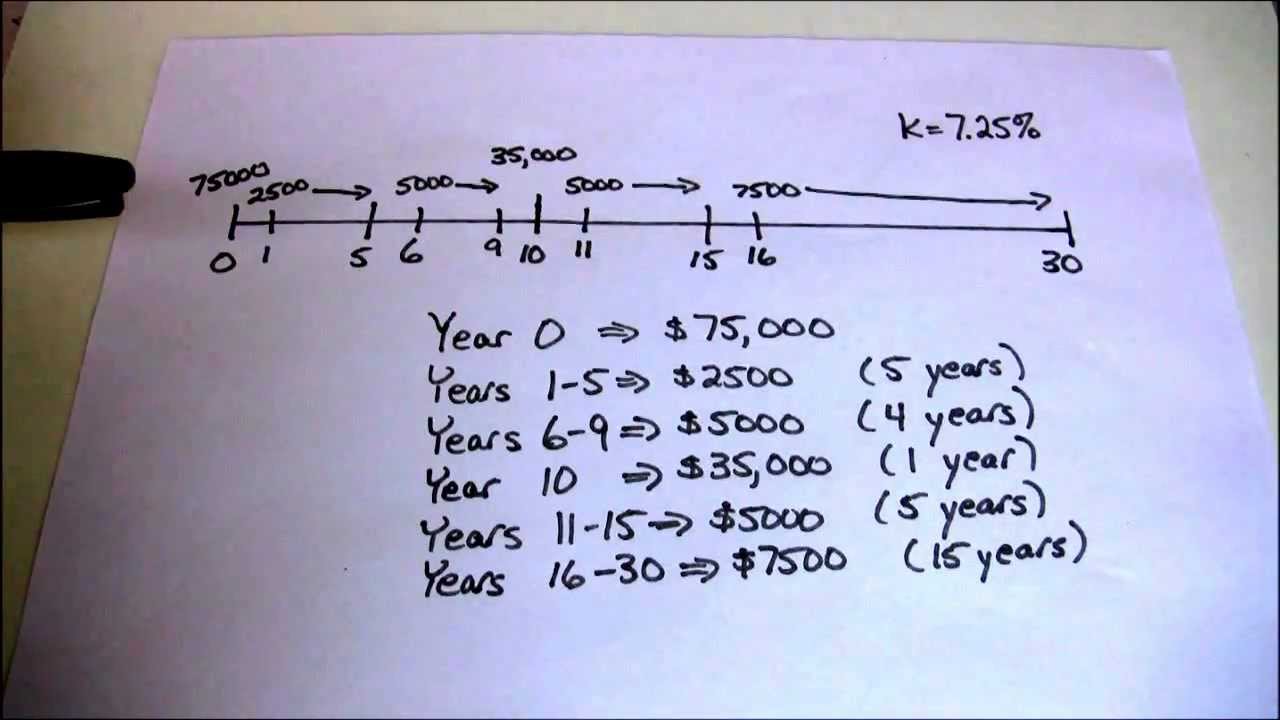

Time Value of Uneven Cash Flows. Here we see how to calculate the Net Present Value and Internal Rate of Return for an uneven stream of future cash flows. Calculating the present or future value of an investment is.

1000 is expected to be. Kelv 678 6 Uneven Cash Flow Stream Find the present values of the following cash flow streams. Using Excel 2007 how do I calculate a payment with uneven cash flows.

View the full answer. C11 is the discount rate. Uneven Cash Flows If cash flows are uneven we cannot use the TVM function in our calculator to find the present value of the cash flows.

This function is defined as. NPV C11C5C9 the NPV function uses a discount rate and series of cash flows to find out the net present value of a financing system. Or payments may be.

In this section we will take a. 1 Start Period Date. To find the present value of an uneven stream of cash flows we need to use the NPV function.

IRR and Uneven Cash Flows.

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Hp 12c Net Present Value For Even And Uneven Cash Flows Youtube

Net Present Value Calculator

Present Value Calculator Wolfram Alpha

Present Value Of Cash Flows Calculator

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

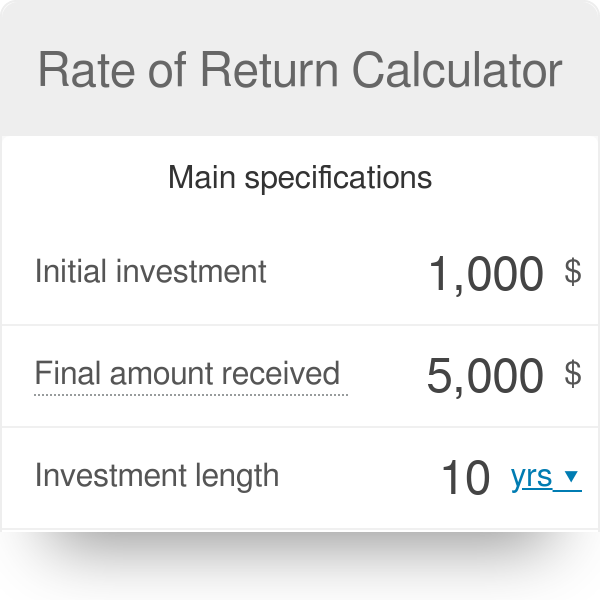

Rate Of Return Calculator

Net Present Value Npv Formula And Calculator

Uneven Cash Flow Streams On The Hp10bii Youtube

Present Value Of Uneven Cash Flows All You Need To Know

Ti Ba Ii Plus Npv Calculation Youtube

Present Value Of An Annuity Calculator Date Flexibility

How To Calculate The Payback Period With Excel

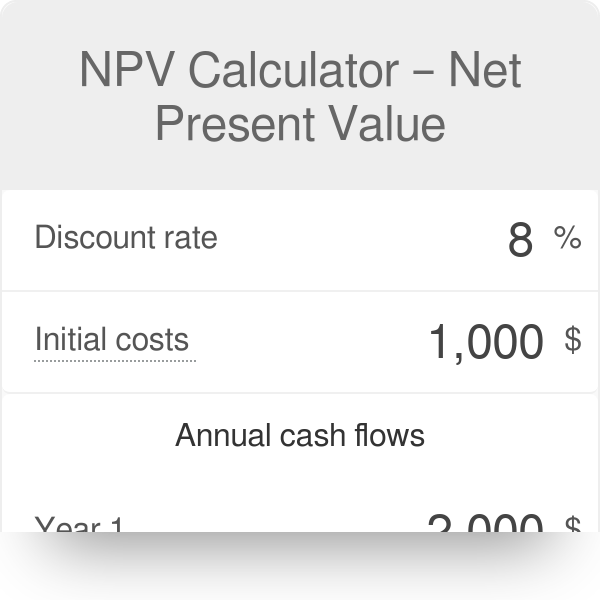

Npv Calculator Net Present Value

Microsoft Excel 3 Ways To Calculate Internal Rate Of Return In Excel

Semiannual Coupon Bond Valuation Mgt232 Lecture In Hindi Urdu 10 Youtube Lecture Business Finance Bond